New Generation

Universal Wealth

Platform Boharr

Try our Product, our team will arrange a demo and help to assist.

End 2 End

Solution for

Wealth Management

Manage Lead, Schedule Calendar Tracking

Convert Lead to Prospect, Follow-up and Onboard

Avoid data duplication – incremental data & single onboarding.

Permanent Scan & Store for digital onboarding documents

Mitigate Staggered Database Storage - Single storage of documents

Manage KYC – Across Status including trigger for eKYC – Risk Category & Assessment

API Plugins, SFTP interface, Pre-defined File Format Interface, No third-party redirection – Seamless customer interface.

Enhanced experience on seamless journey, Transaction Status

Lead & Prospect, Hierarchy Level Reports – Budget, actual and performance reporting, Customer Engagement, Incentive Calculation, Complaint Tracking, Customer Portfolio Access

Business Trackers – Flexibility in setting up Key Trackers

Transaction History, Portfolio Valuation, Performance Returns

Report Management – Generate, upload, download Reports

Export Reports for Internal and External Systems Entity Environment.

Revenue Recognition – on accrual basis, investor level

Revenue Analysis – Trend Analysis, Investor level etc.

Dynamic Charts, Detailed Reporting, Reconciliation – Track Status, fee accrual to receipt, Identify reconciling items for actionable.

Allows to e-sign the trade orders

Perform Online KYC and onboarding documents- eSign

Execute online onboarding documents

Flexibility to regenerate payment link for failed settlements

Tracking Payment Status online

Seamless trade and settlement matching

The Product to make

Wealth Management

Better

Boharr platform is built with a modular approach, seamlessly integrating independent modules to provide a comprehensive wealth management solution that meets the needs of businesses. We understand the importance of a unified platform that offers end-to-end capabilities, and our approach strikes the perfect balance between integration and independence. With our platform, clients can enjoy a flexible and efficient wealth management experience.

Application.

Multi-Product in a Single-Platform (One Application, One View)

Unified user experience, cross-selling, customer retention, or wider revenue stream all in a single platform

Pre-integration and ready to use products

- Mutual Funds

- Corporate Fixed Deposit

- Secondary Market Bonds

- e-Gold

- Peer-to-Peer Investing (P2P)

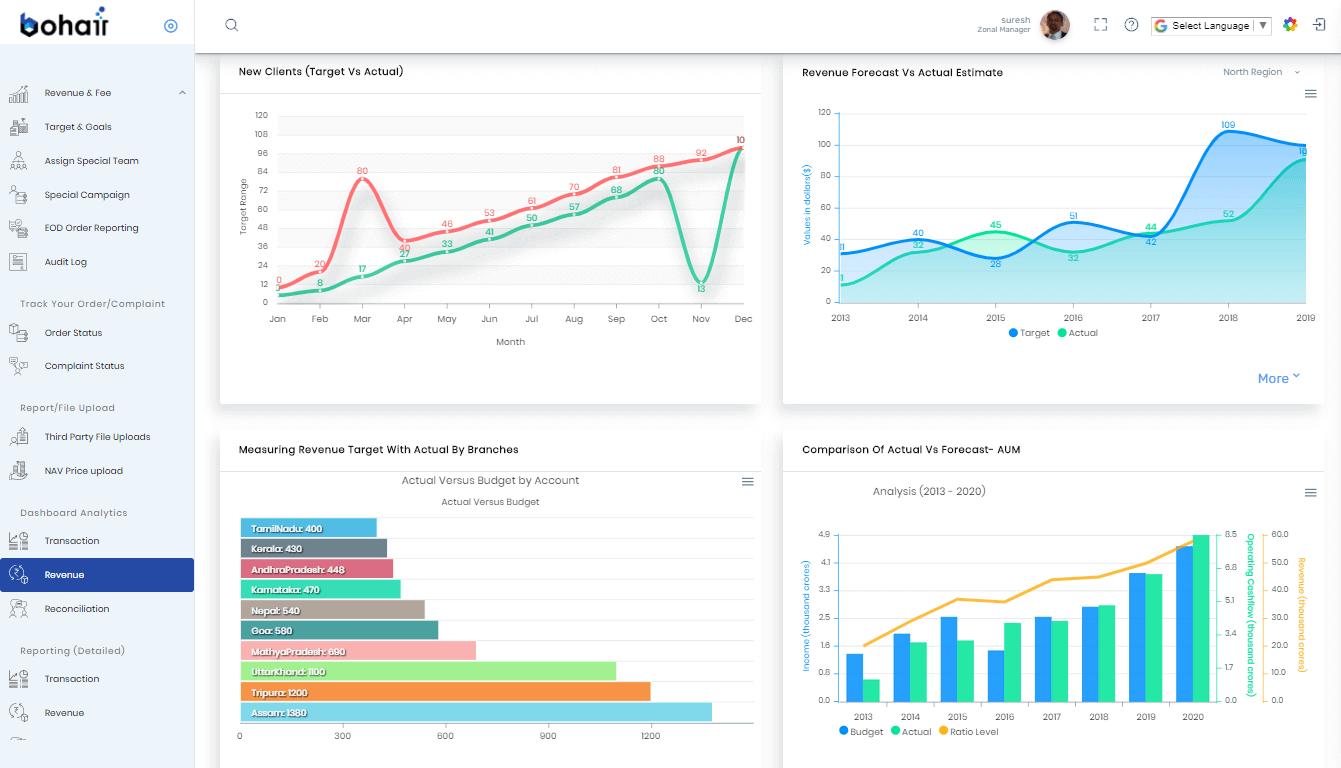

Analytics and Reporting

Import, process and analyse your business data into actionable insights to make informed decisions

- Data Warehouse: Import data across different formats and source

- Data Visualization: Graphical representation for trend and pattern analysis

- Data Analysis: Slice and Dice data across parameters

- Custom Reporting: Tailor reports – prepare ad-hoc reports or dashboards.

- Hierarchical Reporting: View data across any level in the organization

Relationship.

Customer Relationship Manager (CRM)

In-built CRM helps you manage prospect and customer interactions. Now, organise, automate and synchronise sales, marketing and customer service seamlessly

- Contact Manager: Store and organise leads, prospects and customers

- Communication Manager: Customise templates and schedulers

- Sales Tracker: Track leads, conversion and other analytics

- Customer Service: Handle customer enquiries, complaints and requests

- Onboarding KYC: Perform seamless eKYC and reduce customer wait time

Revenue and Sales Manager (RSM)

Improve your sales operation, financial visibility, accuracy and efficiency with a centralised sales and revenue management platform

- Tracker: Capture and record all revenue transactions

- Computation: Automatically calculate revenue across products

- Reporting: Generate real-time and historical revenue

- Reconciliation: Compare and reconcile revenue to check for leakages

Get More...

Respond to the market demand and capitalize on the opportunity with a ready to go live platform.

- Responsive app: Improved user experience across any digital device.

- Cloud Neutral: Ability to run on any cloud infrastructure.

- Rest API: Interoperability with existing internal or external stack, if any.

- Multi Jurisdictional: Ability to operate across multi currency and jurisdiction.

Explore more

We love to hear from you

If you have specific questions or topics, feel free to ask!

We belive together we can and we will make a difference to this investment world